corporate tax increase proposal

22 hours agoThis included a proposed 49 tax increase the maximum allowed by Act 1 as determined by the Pennsylvania Department of Education. P resident Biden has laid out tax increase proposals to fund the American Jobs Plan traditional roads and bridges infrastructure proposal which was accompanied by the Made in America Tax Plan and the American Families Plan human infrastructure proposal.

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Raise the maximum corporate rate.

. At Budget 2020 the government announced that the Corporation Tax main rate for all profits except ring fence profits for the years starting 1 April 2020 and 2021 would be 19. Eighty-seven percent of these revenues are raised from 5 major changes to the corporate tax code though the proposal to raise the US. Proposed Tax Changes in Bidens Green Book Corporate Tax Rate Increase.

A proposed increase in the top ordinary income tax rate from 37 to 39. Enact a new 15 percent minimum tax on book income for large corporations. Raise the corporate tax rate from its current rate of 21 to 28.

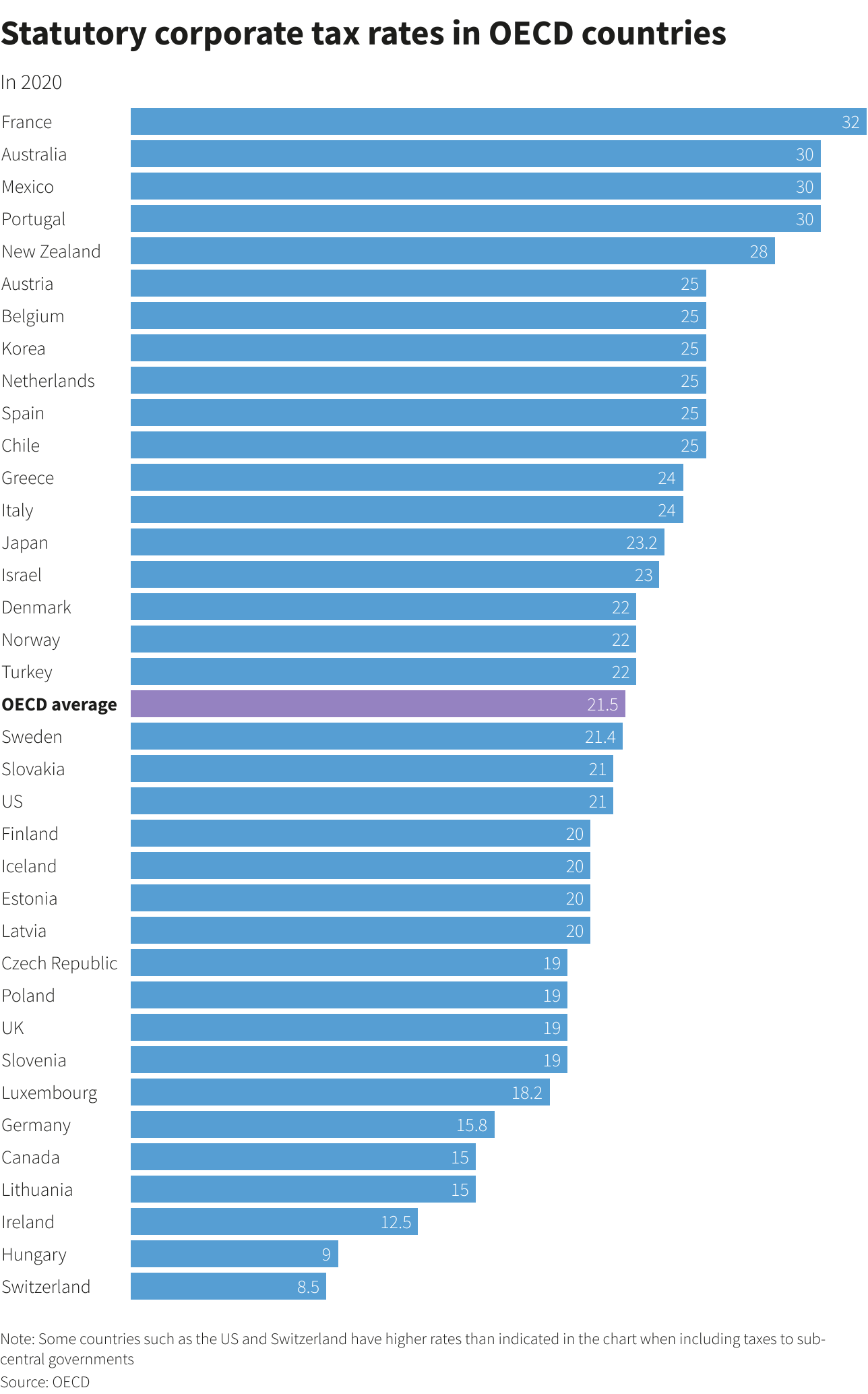

A 32 percent corporate rate a tax rate significantly higher than Communist Chinas 25 percent tax rate. The corporate tax increase proposal in the presidents infrastructure plan would blunt the trajectory of our countrys economic recovery Lincoln writes and. The corporate rate increase would be a much larger tax hike accounting for about 700 billion of new revenue in the original House draft compared to about 200 billion of new revenue from the new minimum tax in the most recent House draft.

House Democrats are expected to propose raising the corporate tax rate to 265 from 21 as part of a sweeping plan that includes tax increases on the wealthy. Subtitle I Corporate and International Tax Reforms. The citys Business Improvement District tax more commonly known as the BID tax is 150 per night.

The budget also would increase the corporate tax rate from the current 21 to 28 and institute measures supporting. This is an increase from the current 21 to 28. Democratic presidential candidate Joe Biden has promised not to raise taxes on anyone making less than 400000 a year but his proposal to raise the corporate tax rate from 21 to 28 would.

Biden also proposed raising the corporate tax rate to 28 from 21 as part of his budget request and pitched a global minimum tax thats designed to crack down on offshore tax havens. President Bidens administration has made a proposal to increase the corporate tax rate. Which tax increase proposals can be enacted and how depends on Congress.

13 trillion tax increase. After noticing Mitchells BID tax is below lower than all. 4 hours agoThe proposal to increase the hotel tax rate from 5 to 8 and meals tax rate from 4 to 6 is part of the countys fiscal year 2023 budget process.

Corporations by 9636 billion over the next decade. Raise the corporate income tax rate to 28 percent. Corporations including income from countries that.

This is a cornerstone of the proposed tax increases. Reflecting the scale of the tax increases the rate hike would have a much larger economic impact than that of the book. This tax increase will be passed along to families in the form of higher prices of goods and services.

Increase the corporate tax rate to 28 percent from the current 21 percent rate. Increase the minimum corporate tax rate to 21 for all US. Many of the proposals.

How the Proposed Corporate Tax Rate Increase Affects Small Business Owners September 21 2021 Business Valuation Tax and Estate Planning Sam Brownell was recently quoted in an article from The Business Journals titled What small-business owners need to know about the potential tax hike and wrote this blog post as a follow-up piece with. Frank said the projected enrollment for next year is 6912. This is estimated to raise 13 trillion in additional tax.

19MITCHELL A proposed 50 cent increase to the citys Business Improvement District tax on hotels and lodging establishments has sparked opposition from nearly a dozen local hotel owners. Increase the corporate tax rate to 28. Ways and Means Committee Chairman Richard Neal has proposed 25 new tax policies that would on net raise taxes on US.

After accounting for state corporate taxes Biden will give the US. The House proposal would take huge steps to reverse the 2017 Republican tax cuts. Individual Top Marginal Income Tax Rate Increase.

WASHINGTON Sept 12 Reuters - US. Revenue provisions in the proposed budget prominently include what an administration fact sheet calls a new billionaire minimum income tax of 20 on both realized and unrealized gains and other income of the nations wealthiest individuals. It would hike the corporate rate to 265 after the GOP slashed it to 21 from 35.

President Bidens tax proposal would. Business owners say the tax hikes will burden. Raise the top individual tax bracket to 396.

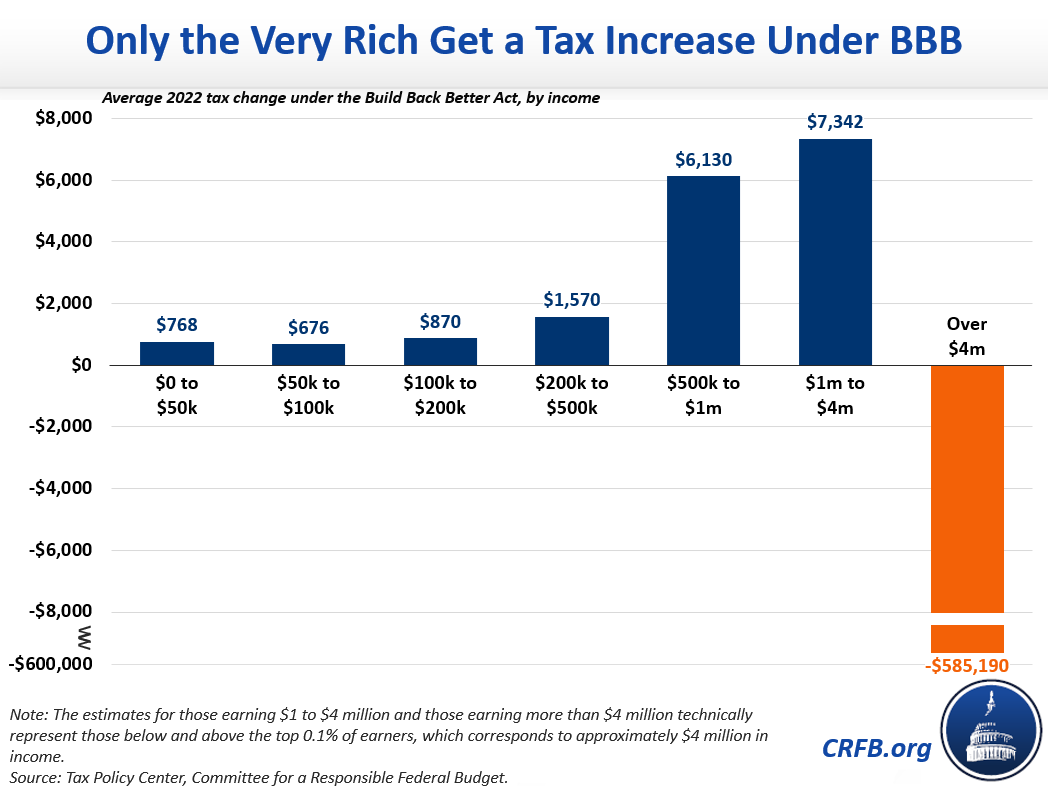

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

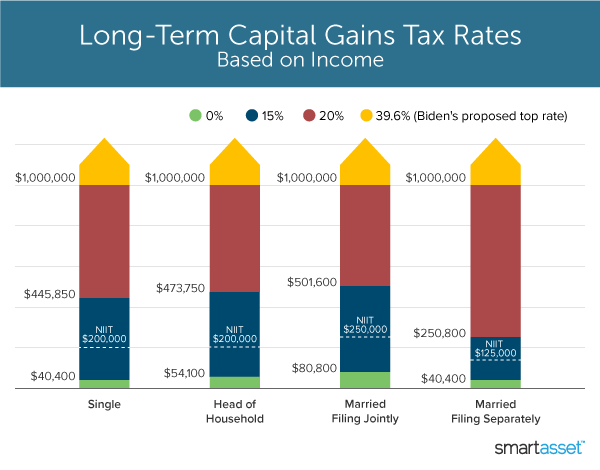

Biden To Propose Capital Gains Tax Hike To Fund Education Child Care Reports

What S In Biden S Capital Gains Tax Plan Smartasset

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Individual And Corporate Tax Reform

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Countries Agree With Plan To Set Minimum Corporate Tax Rate World Economic Forum

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Tax Cuts And Jobs Act Tcja Taxedu Tax Foundation

What Are The Consequences Of The New Us International Tax System Tax Policy Center

President Biden Unveils Plan To Raise Corporate Taxes The New York Times

Corporate Tax Reform In The Wake Of The Pandemic Itep

How A Global Minimum Tax Would Deter Profit Shifting And One Way It Would Not Piie

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Corporate Tax Reform In The Wake Of The Pandemic Itep

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)